The H-1B1 visa program is a quiet cousin of the H-1B, carved out of U.S. trade deals with Chile and Singapore.

With 6,800 slots per year reserved — 1,400 for Chile, 5,400 for Singapore — you’d expect Singapore to dominate.

But the numbers tell a different story. Here’s who’s really using the program, and what that means.

The Basics

The H-1B1 visa is a cousin of the H-1B, created by U.S. trade deals with Chile and Singapore. It reserves 6,800 slots annually: 1,400 for Chile and 5,400 for Singapore.

Limited Club

Unlike the H-1B, which is global, the H-1B1 is only open to Chilean and Singaporean citizens. No other countries qualify.

Early Years

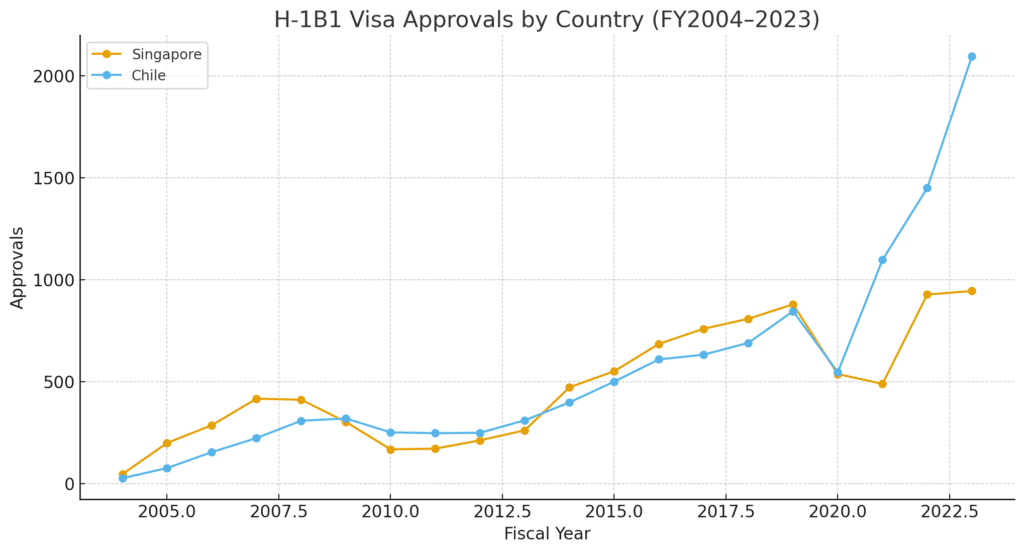

From 2004 to 2010, approvals were modest — fewer than 1,000 combined visas each year. The program sat under the radar.

Chile’s Rise

Starting mid-2010s, Chile’s usage began to climb. By FY 2023, Chile recorded 2,095 approvals, surpassing its nominal 1,400 cap.

Singapore’s Decline

Singapore once dominated H-1B1 visas. But in FY 2023, it logged just 944 approvals — only about 17% of its quota.

Closing the Gap

By 2019, Chile and Singapore were neck-and-neck. By 2021, Chile pulled ahead, doubling Singapore’s tally two years later.

Underused Program

Even with Chile’s surge, combined approvals in 2023 totaled 3,039 — less than half of the 6,800 slots available. Thousands go unused annually.

Employer Patterns

U.S. employers appear more inclined to hire Chilean professionals under H-1B1, while Singaporeans often use other visa channels or skip the program entirely.

The Trendline

Charts show a clear story: steady growth overall, Chile surging past Singapore, but both countries still leaving capacity untapped.

The Prediction

Expect Chile to dominate future H-1B1 usage. Singapore will likely continue under-utilizing its allocation, leaving the program under the radar despite its potential.