2025’s tariff storm is rewriting trade in real time, according to traders on Kalshi, there’s an 81% chance that Trump imposes tariffs on semiconductors this year.

With U.S. levies soaring as high as 145%, companies are scrambling to redraw their shipping maps, diversify sourcing, and dodge costs that could sink margins.

What was once a quiet logistics story is now global chess—and these are the reroutes reshaping the game.

Asus Pulls Out of China

Asus has shifted over 90% of PC and motherboard production to Thailand, Vietnam, and Indonesia. Server production is coming back to the U.S., a direct strike against rising tariffs.

India’s Epsilon Seizes Graphite Market

After a 93.5% tariff on Chinese graphite, India’s Epsilon is investing $650M in a new plant in North Carolina—positioning itself as America’s new battery backbone.

Breville’s Backup Plan

The appliance maker is expanding output in Mexico and Indonesia to cut exposure to 25–19% tariffs on Chinese goods, while using freight optimization and inventory stockpiles to soften the blow.

Thailand Tightens Transshipment Rules

Facing U.S. scrutiny, Thai customs are cracking down on rerouted Chinese goods, adding surprise factory checks to certify “Made in Thailand” claims.

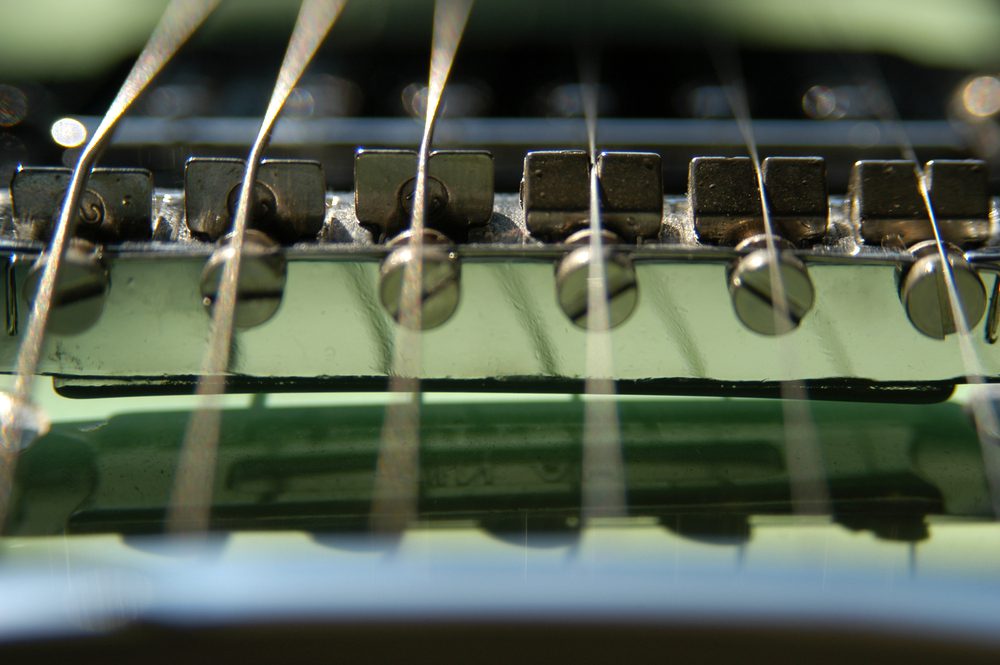

Guitar Strings in the Crossfire

D’Addario, the U.S. guitar-string giant, faces 25% tariffs on Japanese components. Their response: a trade-war task force, overseas packaging, and a bid for Free Trade Zone relief.

Canada & Mexico as Loopholes

Importers are funneling goods through Canada and Mexico, where tariffs hover around 25%, instead of paying 145% on China. Others stash shipments in bonded warehouses to delay duties.

The Nearshoring Wave

Deloitte reports 40% of U.S. companies plan to move production closer to home by 2026, with Mexico, Canada, and U.S. states like Texas reaping the benefits.

Half of Companies Already Rerouted

A recent supply chain survey found that 50% of U.S. companies have already shifted suppliers or shipping routes directly because of tariffs.

Import Drop Incoming

After a July import spike, U.S. trade flows are forecast to fall nearly 20% by year’s end as frontloading runs dry and tariffs bite harder.

Tariff Shock in August

An August 7 rule change ratcheted tariffs up to 40%+ on some imports, forcing another round of sourcing detours and contract rewrites.

Agility Becomes Strategy

Companies are leaning on Foreign Trade Zones, supplier swaps, and just-in-time rerouting to stay afloat—building tariff navigation into their core playbooks.

Tariffs Are the New Normal

Experts warn that trade wars are now part of the supply chain baseline, like pandemics or conflicts. Winning means mastering agility, not waiting for relief.