Trades on Polymarket spiked ahead of Donald Trump’s pardon of Binance founder Changpeng Zhao (CZ) last week. According to tweets published by AI-powered analytics tool Polysights, several wallets were placing bets on Zhao markets, a pattern previously seen in other politically charged prediction markets.

witnessing some interesting activity the past month, especially the last week

Posted about this in @predictionarc but think it’s time for an X breakdown

will this take us to 14-1? 👇 pic.twitter.com/IvIrJmdQaZ

— Polysights (@Polysights) October 13, 2025

Zhao, the founder of one of the world’s largest cryptocurrency exchanges, was sentenced to four months in prison in 2024 over violations of anti-money laundering (AML) laws.

In a press briefing, White House press secretary Karoline Leavitt said Trump exercised his “constitutional authority” in issuing the pardon, adding that Zhao’s case was “overly prosecuted by the Biden administration.”

“Even the judge in the case admitted that the Biden administration was pursuing an egregious over-sentencing of this individual, and the previous administration was very hostile to the cryptocurrency industry.”

Following Zhao’s pardon, trading in favor of a pardon for Sam Bankman-Fried (SBF) surged on both Polymarket and Kalshi. SBF, the founder of bankrupt crypto exchange FTX, was convicted of fraud and sentenced to 25 years in 2024.

Insider trading allegations spark following market spike

According to tweets published by Coffeezilla, an internet detective exposing scams, an account linked to user “bigwinner01” made over $56,000 on Polymarket’s “Will Trump Pardon CZ in 2025?” market. This raised speculation over insider trading, as the same user had previously made $190 million on Hyperliquid decentralized perpetual exchange by placing trades ahead of market-moving Trump tweets.

Other community members were not as eager to agree that this person had insider knowledge. According to user @abbasshaikh42, speculation about a Zhao pardon has been circulating for months, and the user’s big bet could have been a lucky guess.

Speaking with Prediction News, the board of directors and VP of marketing at Voltage, a payment provider for stablecoins and Bitcoin, Bobby Shell, added that events like these demonstrate the growing informational value of prediction markets.

“When traders profit from correctly anticipating real-world legal outcomes, it validates the model: collective intelligence can forecast complex, high-stakes events.”

Prediction News market analyst Matt Schmitto explained in a recent opinion piece why insider trading is more of a feature than a bug in prediction markets, but acknowledges that it comes with tradeoffs.

Hedy Wang, the CEO and co-founder of Block Street, a unified liquidity layer for tokenized assets, said that while events like Zhao’s pardon push prediction markets closer to legitimacy, structural challenges remain.

“When a single event, like a pardon, generates real profit across decentralized markets, it chips away at the old argument that prediction markets are just toys. But for them to really ‘arrive,’ they need more than hype; they need depth.”

Traders reassess political risk in crypto industry

Zhao’s pardon has not only stirred debate within the media and crypto community, but has also prompted prediction market traders to reassess the landscape of political risk in the industry.

The shift was evident in the surge of bets on Polymarket and Kalshi concerning a potential pardon for former FTX CEO Sam Bankman-Fried.

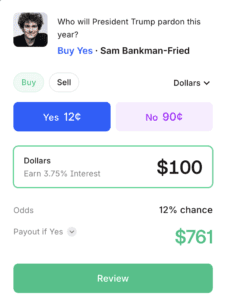

SBF’s odds on an open market on Polymarket jumped by more than 50% on October 24, following CZ’s pardon. The market currently prices SBF’s odds at 9% (9.5¢) as of noon ET on Oct. 28. Similarly, an open market on Kalshi projects Bankman-Fried’s pardon odds at 12% (12¢).

The uptick in betting activity underscores a growing sentiment among crypto natives that the US political climate may be shifting. Potentially, CZ’s pardon could also open the door for clemency in more high-profile cases such as SBF’s.

Shane Molidor, the founder of Forgd, emphasized that Binance’s early risk-taking was a product of an underdefined regulatory environment, which is no longer the case.

“For years, crypto operated in a legal grey zone, and early builders took on significant compliance risk not out of malice, but due to a lack of clarity around what the actual ‘rules of the road’ were. The pardon is a tacit acknowledgment of that ambiguity. It doesn’t mean the U.S. is going soft on AML; rather, it reflects the reality that enforcement today is a very different game than it was when CZ was building Binance.”

At the same time, CZ’s pardon underscores that personality-driven enforcement has limits, Voltage’s Shell added.

“The market’s reaction suggests optimism that crypto can outlast individuals, that the next chapter will be more about frameworks and innovation than prosecutions.”