Stocktwits, a social media platform for stock traders and investors, has announced a new partnership with Polymarket, the largest crypto-based prediction market exchange.

Stocktwits provides real-time stock market tracking and gives a platform for traders and investors to discuss market movement and share insights. Stocktwits also incorporates the latest news related to the stock market to further help its users make informed trading and investment decisions. Those sources will now include info and direct links to related Polymarket financial markets.

Huge news: We’ve partnered with @Polymarket, making them our Official Prediction Markets Partner!

Our 10M+ community can now see real-time probabilities for market-moving events like earnings, right where the conversations happen. pic.twitter.com/CjTbbLLig8

— Stocktwits (@Stocktwits) September 15, 2025

Stocktwits users get Polymarket insights next to their trading conversations

The new partnership makes Polymarket the official prediction markets partner of Stocktwits, which the company says is its largest-ever strategic partnership.

Stocktwits says in a press release announcing the partnership that, as a result of the deal, its 10 million members “will be able to see Polymarket’s real-time, crowd-priced probabilities alongside the conversations they’re already having about earnings, sentiment, and market moves, resulting in a streamlined path to act on these views on Polymarket.”

Stocktwits founder and CEO, Howard Lindzon, says the partnership will provide crucial additional details and context to help its members make even more informed decisions.

“We are living in a post real-time world where trust, community, and great signals matter more than speed,” Lindzon said in the press release. “Polymarket has created an entirely new way to understand news and expectations, and Stocktwits is the place where millions of investors already gather to share ideas and sentiment. Together, we can help investors cut through noise and focus on the probabilities that matter most.”

Stocktwits says it will begin rolling out Polymarket details and embeds “with earnings markets for widely followed companies,” then expand.

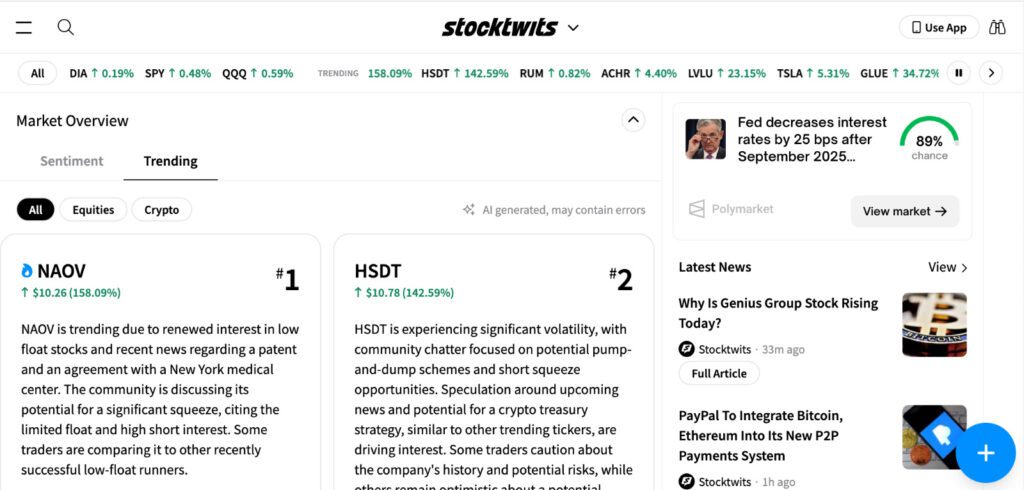

The Stocktwits homepage features an embed of Polymarket’s market related to the Fed’s forthcoming decision on interest rate cuts. Users who access Stocktwits through its app get a pop-up window promoting the same market. So it appears Stocktwits will also showcase broader financial prediction markets beyond just those directly related to company stock earnings and movements.

Stocktwits will also have direct links to trade on Polymarket

With info from Polymarket embedded alongside news sources and conversations with fellow traders, Stocktwits users will not just have additional trading info. They’ll also be able to follow links to the relevant Polymarket prediction market to invest additional money on stock market outcomes, which provides more hedging opportunities.

It’s a win-win deal for both sides of the partnership. Stocktwits members will have a new, reliable, real-time resource. And Polymarket will have its prediction markets spotlighted in front of a valuable target audience, who will have direct links to access the prediction platform and make trades.

“Prediction markets transform uncertainty into clarity by turning big questions — like earnings — into simple, tradable outcomes with transparent pricing,” Matthew Modabber, chief marketing officer at Polymarket, said in the press release. “Partnering with Stocktwits allows us to put that power directly into the hands of millions of investors where they already live and engage, reshaping how markets process information.”

Prediction market platform partnerships on the rise

Polymarket is gearing up for an imminent return to the U.S., after legal challenges that prevented the platform from accepting trades from U.S. users were settled. In July, Polymarket also announced it had acquired the CFTC-approved exchange platform and clearinghouse QCEX, which set the stage for Polymarket to re-launch in the U.S. any day now.

With the recent rise in attention, prediction market platforms have been increasingly announcing partnerships with outside outlets to further market their platforms, provide more trading tools, and expand their trader bases. Kalshi, for example, has partnered with retail brokerage apps like Robinhood and Webull, allowing those platforms to offer a variety of prediction markets on their platform.

Polymarket also announced a partnership with the X’s AI product Grok, which provides news and other related info directly within a wide range of prediction markets (Kalshi has a similar deal with xAI). As a result of the partnership, Grok is also used to power Polymarket’s interactive “Ask Polymarket” X account.