After a few weeks of beta testing, Polymarket, the self-professed “world’s largest prediction market,” has officially returned to the U.S. after a nearly four-year absence. The prediction platform says that, starting today, those who signed up and joined the waitlist will now be able to access the Polymarket app, with invites being sent out “on a rolling basis.”

The Polymarket app for U.S. traders is currently only available for Apple mobile device users in the App Store. Polymarket says the Android app is “coming soon.” The polymarket.us website is still not activated, but users can still sign up for a waitlist spot on the site.

Against all odds.

Polymarket’s U.S app is now being rolled out to those on the waitlist.

We’re launching with sports — followed by markets on everything. pic.twitter.com/WOoVMszrqc

— Polymarket (@Polymarket) December 3, 2025

Polymarket U.S. app so far very different from international platform

Anyone who has seen or used Polymarket’s international platform will find the app for U.S. users to be quite different so far.

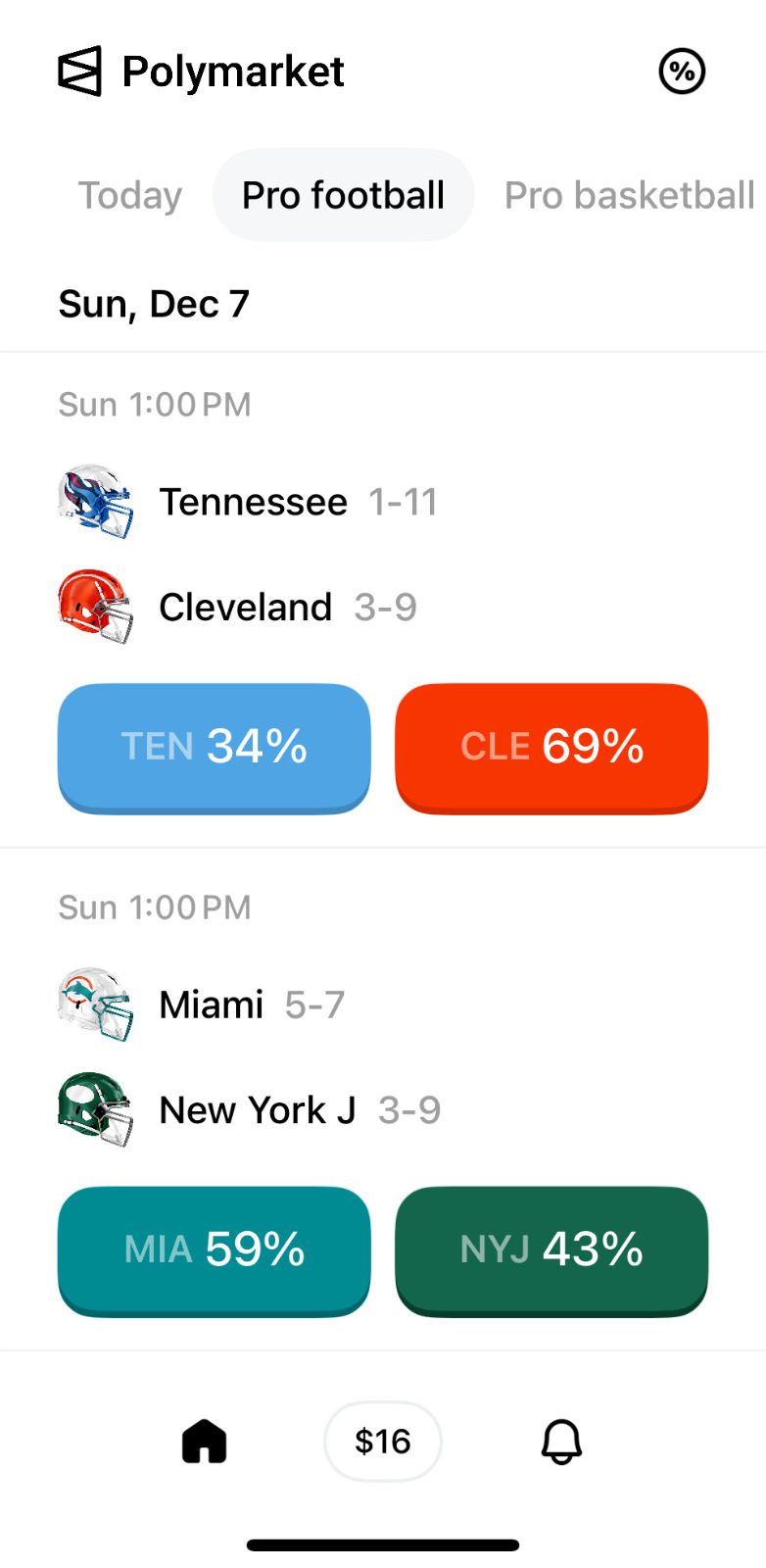

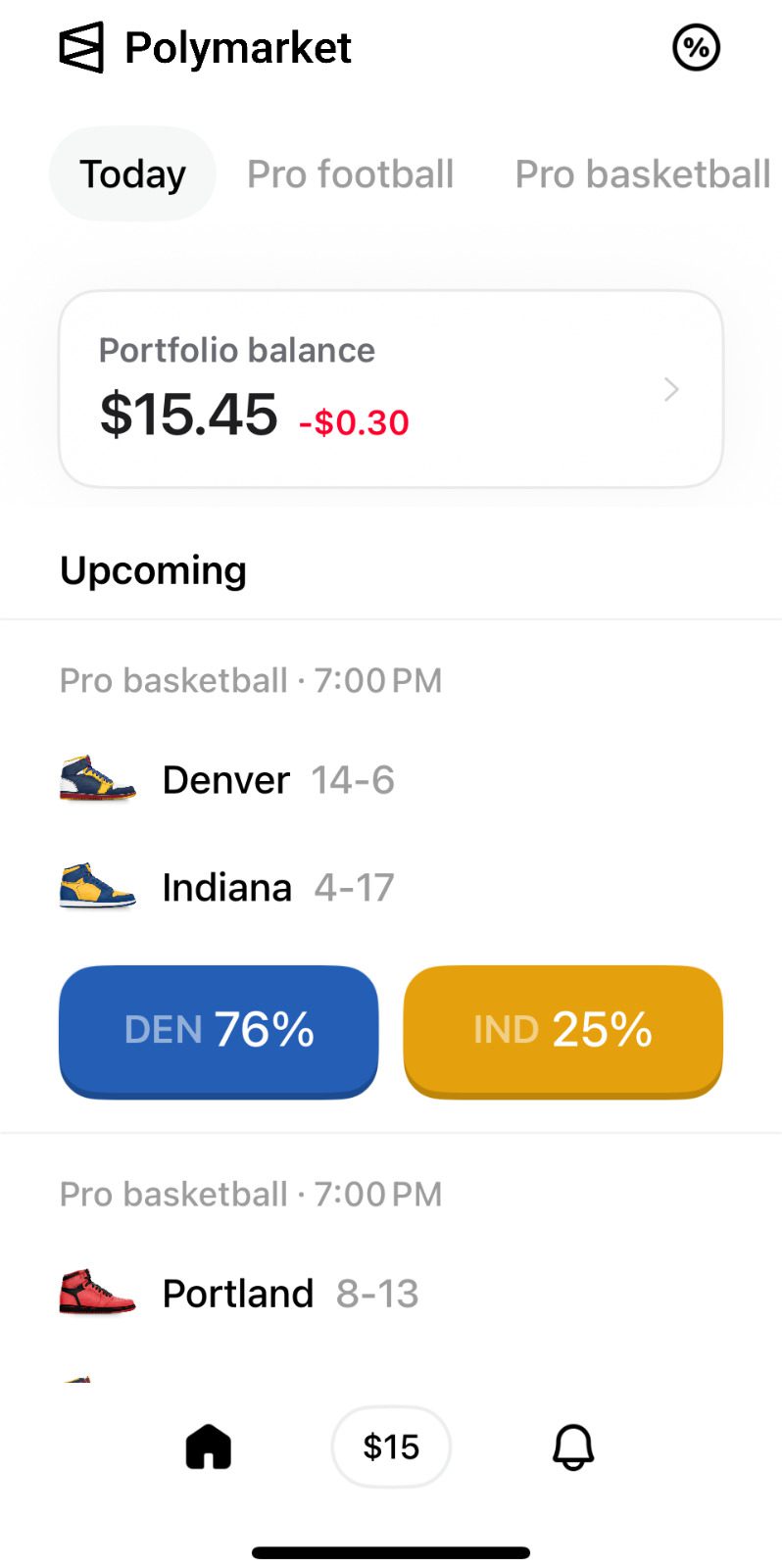

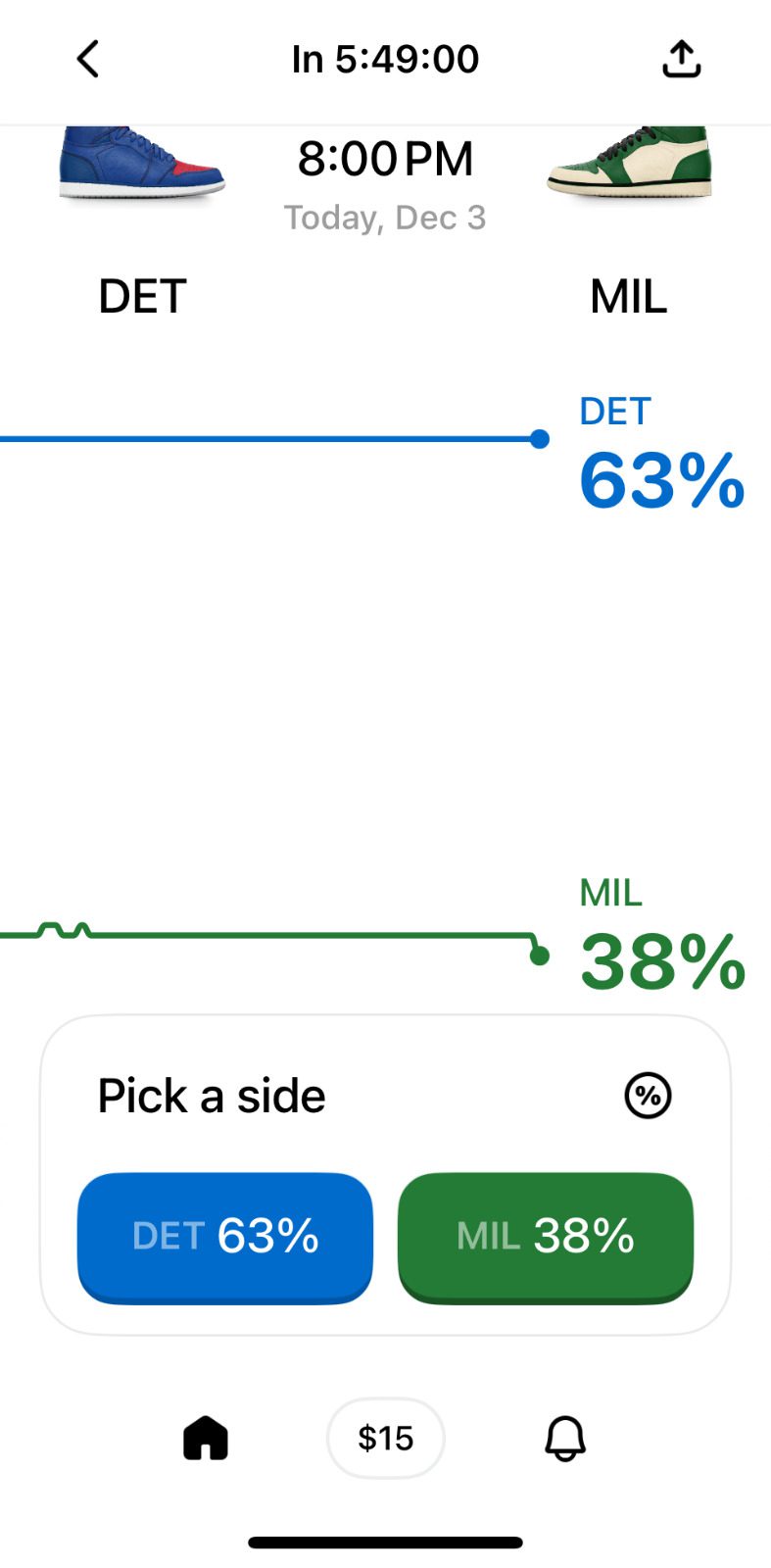

For one, there are currently only sports markets in which users can trade on NFL and NBA game winners. Polymarket’s initial self-certified contracts, filed with the Commodity Futures Trading Commission (CFTC), also included sports event contracts for point spreads and totals, so those will likely be the next markets added.

The app says that “more polymarkets are coming soon,” including those related to crypto, tech, politics, and more.

Another difference between the U.S. and international Polymarket platform is in the funding and withdrawal process. While outside of the U.S., Polymarket solely operates on cryptocurrency, so far the U.S. app only accepts fiat payments — bank cards and bank and wire transfers. It seems likely that crypto banking options will also be forthcoming.

Polymarket US app sign-up, withdrawal and other details

I was able to access the Polymarket app on Monday night. New users are given a $10 trading credit after a quick sign-up process, which requires a Social Security number. I placed my first trade on Monday Night Football and was impressed with how quickly it settled immediately after the game. I decided to test the withdrawal process, requesting $10 to be sent to my bank card Monday night. As of Wednesday afternoon, I still hadn’t received the payout and it is still shown as pending within the app.

Like Kalshi, Polymarket’s sports markets don’t use full team names or logos, to avoid any copyright conflicts with the pro leagues. And while the NBA markets show each team’s colors on the icons featured in the markets, the NFL markets show the NFL teams’ helmets with slightly modified logos. The Dallas Cowboys helmet, for example, features a cowboy hat with a star on it, instead of the team’s usual trademark blue star.

Polymarket ordered to prohibit U.S. traders in 2022

Polymarket was founded in 2020 by NYC native Shayne Coplan, inspired by his interests in computer science, cryptocurrency and blockchain technology. Polymarket launched just prior to the 2020 presidential election, which helped draw wider attention and trading volume to the platform.

Polymarket’s 2020 seed funding round raised $4 million, led by Polychain Capital, while subsequent funding rounds in the last two years raised larger amounts and have included investors like General Catalyst, Peter Thiel’s Founders Fund and other tech- and crypto-focused VCs. (A $200 million funding round earlier this year put Polymarket’s value at more than $1 billion.)

Polymarket saw substantial growth in 2021, with a growing global trader base and rapid expansion of market offerings, including those related to politics, economic indicators, pop culture, sports, and much more.

Later in 2021, the CFTC announced it was investigating Polymarket for offering “off-exchange event-based binary options contracts” without obtaining approval from the CFTC to operate as a designated contract market (DCM) or swap execution facility.

On Jan. 3, 2022, the CFTC fined Polymarket $1.4 million for the alleged violations, and ordered the platform to stop offering its prediction markets in the U.S. Polymarket obliged and blocked U.S.-based traders from using its platform.

Polymarket acquired CFTC-approved exchange in July

Despite the U.S. block, Polymarket continued to grow and expand its market offerings around the world. Polymarket’s 2024 U.S. presidential market reportedly amassed more than $3 billion in trading volume ahead of election day and drew widespread media attention for being more accurate than what traditional polls were reporting.

With Polymarket’s profile continuing to rise, Coplan faced more governmental pushback just after the 2024 election, when the FBI raided his home and reportedly seized his phone. The Department of Justice was reportedly investigating Polymarket for allegedly still allowing U.S. traders to access the platform.

Polymarket’s fortunes in the U.S. would change drastically with the incoming Trump administration, which was showing signs of taking a more favorable and permissive approach to prediction markets as Polymarket was making moves for a U.S. re-entry.

In July of this year, the DOJ and CFTC announced they had ended their probes of Polymarket without any charges being issued. Days later, Polymarket announced it had acquired QCX (as well as its clearinghouse) for $112 million. QCX had recently received CFTC approval to operate as a DCM, so the acquisition provided a clear path for Polymarket to return to the U.S.

The QCX CFTC filing was updated shortly after the acquisition with the note: “QCX LLC is now operating under the assumed name of Polymarket US.”

In early October, it was announced that the owner of the New York Stock Exchange, Intercontinental Exchange, was investing $2 billion in Polymarket, pushing the company’s valuation to $9 billion. Bloomberg reported that Polymarket’s next round of funding could put its valuation at up to $15 billion.

Polymarket also reportedly intends to launch its own cryptocurrency soon. In late October, Polymarket’s CMO, Matthew Modabber, said the POLY token was slated for release some time after the platform’s U.S. relaunch.

Polymarket US to face off with Kalshi, others for U.S. market supremacy

Polymarket has grown substantially since its U.S. exit. The platform’s biggest rival in the U.S. prediction market space will be (at least initially) Kalshi, which has been riding a similar wave of success in the past year. In Polymarket’s absence, Kalshi (which has had full CFTC approval as a DCM) has dominated the domestic prediction market space.

Polymarket regularly topped Kalshi in worldwide prediction market trading volume, but Kalshi has inched ahead since the 2025 football season started thanks to the popularity of its NFL and college football markets. Previously only available in the U.S., Kalshi announced in October that it was going international and expanding into more than 140 countries.

For the month of November, according to Dune Analytics, Polymarket’s notional trading volume reached an all-time monthly high of $4.3 billion, topping its previous high of $4.2 billion in October of last year, when the U.S. presidential election was a huge volume driver. Kalshi also had a record-setting month in November, attracting $5.5 billion in trading volume.

Polymarket’s U.S. return should provide a substantial boost in trading volume. While Polymarket’s battle with Kalshi for customers will be watched closely, the two incumbent heavyweights in the space will also be facing challenges in 2026 from new prediction platforms from FanDuel, DraftKings, Robinhood and Fanatics, which is rolling out its Fanatics Markets app this week.