While traders were sweating blocked kicks and trying to figure out if and when Jimmy Kimmel Live! will return to television, Kalshi quietly turned on a new volume incentive program that pays traders pro‑rata rebates for driving activity in specific markets, a bid to deepen liquidity and boost pricing efficiency.

Kalshi filed the framework with the Commodity Futures Trading Commission (CFTC) on Aug. 31 and said the program would take effect upon exchange notice. On Sept. 18, Kalshi announced the program’s launch by sharing a PDF with rules in the company’s Discord, and over the weekend eligible markets began displaying in‑product indicators highlighting active reward terms.

How Kalshi’s volume incentive program works

For the current one‑week term (12:00 a.m. Sept. 18 through 12:00 a.m. Sept. 25), Kalshi is concentrating rewards in NFL Week 4 markets and a handful of culture contracts:

- Billboard Top 200 #1 on Oct 4, 2025 chart?

- Will any MrBeast video get more than 100 Million views a week after upload in September?

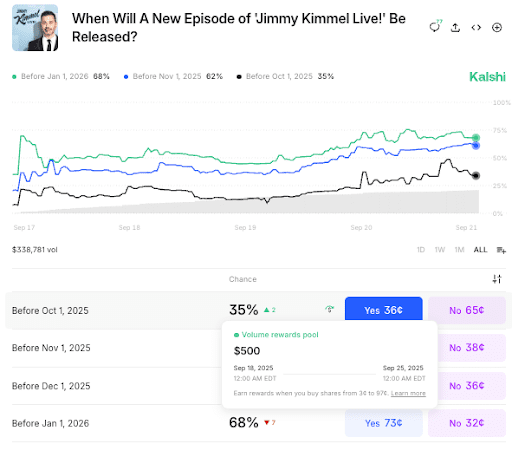

- When Will A New Episode of ‘Jimmy Kimmel Live!’ Be Released?

The rewards are volume‑weighted and measured on both sides of each matched trade (maker and taker), so the $0.005 per‑contract cap applies per participant—effectively $0.01 total per matched contract. At the end of the term Kalshi allocates each market’s reward pool in proportion to each participant’s share of “eligible volume,” defined as central order‑book trades executed between 3¢ and 97¢.

The program is open to all members except Kalshi affiliates, contracted market makers, and introducing brokers/FCMs and their customers. Kalshi says it will post current and planned reward terms on market pages and retain the right to revoke participation for abusive behavior. The exchange can amend or terminate the program at its discretion.

Why now and where the incentives point

Strategically, the timing lines up with Kalshi’s sports push and incoming competition in the prediction‑market space, including rival Polymarket’s imminent U.S. return. Football has propelled heavy activity on the exchange this month. While the volume rewards pools are too small to have an effect in NFL markets that already are robust with liquidity, it is a timely marketing nudge as users will soon have more places to trade.

The pools also seed a few buzzy culture markets, showcasing Kalshi’s breadth beyond sports and tapping storylines in the wider news cycle. The MrBeast 100‑million‑views sprint has become a recurring community parlor game, and the Kimmel controversy, after ABC suspended the show, sits atop headlines across the country.

Running $500 reward pools alongside those narratives gives traders a reason to put some skin in the game in markets they might otherwise overlook.

Traders point out flaws

Kalshi’s filing frames the purpose plainly: push more volume through the central limit order book to “enhance pricing efficiency.” Traders on the platform praised the concept but several questioned the design. One refrain: don’t set incentives above the combined taker+maker fees at the edges of the eligible price range (3¢–97¢).

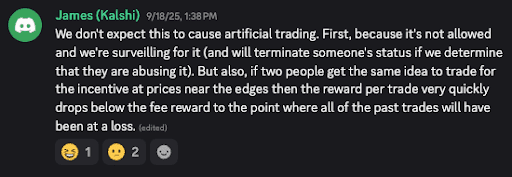

“If someone can take advantage of a system like this, they will. Don’t build systems that encourage wash trading, especially where that is illegal,” a trader replied in Kalshi’s liquidity-and-fees Discord channel, suggesting that in thin books a savvy pair could profit purely from rebates.

Critics also noted that counting maker and taker volume means rewards accrue at the maximum $0.005 per side until aggregate weekly volume in a rewarded market crosses a break‑even threshold. With a $500 pool, that simple back‑of‑the‑envelope threshold is ~50,000 matched contracts for the week before per‑contract incentives start dropping. The worry is that the math could leave a window where rebate-driven churn is positive EV.

A Kalshi employee replied that the exchange “doesn’t expect artificial trading,” which is prohibited and surveilled by the company.

The exchange says it will post eligibility and future reward schedules on market pages and will monitor for manipulation or abusive behavior. The program can also be amended or terminated at the exchange’s discretion.

Kalshi’s volume incentive program is an attempt at a straight-forward, exchange-style rebate for activity. If it works as intended, spreads could tighten in some markets, and traders will see a small offset to their costs. There are concerns, however, and the next few weeks will show whether the program will require adjustments.