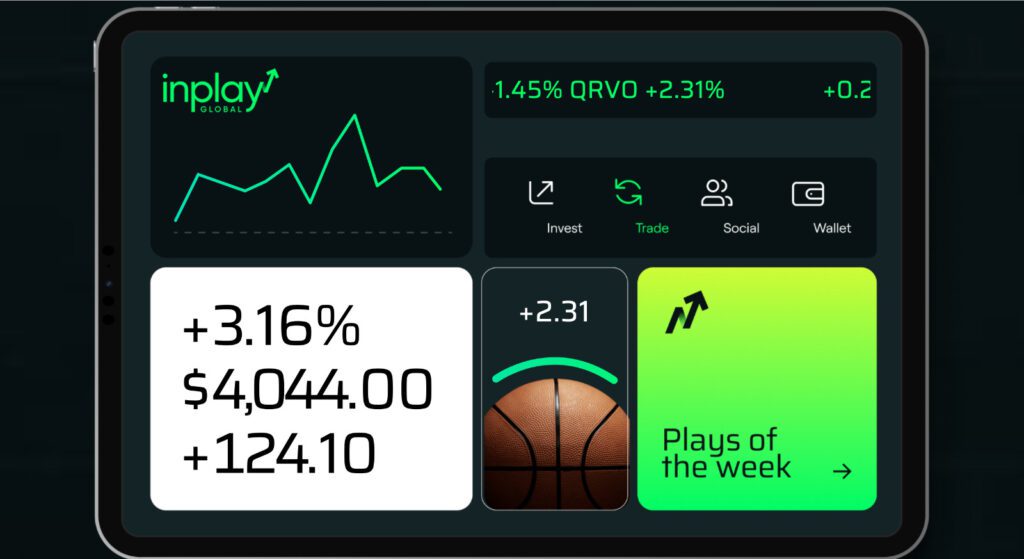

Miami-based InPlay Global, Inc. is aiming to launch a new trading venue that they say will offer “the world’s first regulated securities tied to the real-time performance of college and professional sports teams.”

InPlay would offer what it calls Performance Securities, a “new asset class” that the company conceived of and trademarked. The company says these securities will let investors trade on team performance “across seasons, playoffs, and tournaments,” with pricing based on wins and losses, as well as “fan sentiment” on the platform.

InPlay plans to offer these services nationally. But, unlike prediction market platforms that require approval from and compliance with the Commodity Futures Trading Commission (CFTC), as a securities trading venue, InPlay is awaiting approval from the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) before launching.

The company says the securities will be traded on InPlay Markets, an Alternative Trading System overseen by FINRA and issued under SEC Regulation A Tier 2.

“Just like stocks trading in a secondary market, we are providing access to all investors to trade and invest in sports performance,” InPlay’s new president and COO Troy Kane said in an interview with Bloomberg. “We are trying to make this a broader asset class, similar to how (Exchange-Traded Funds) were developed years ago.”

InPlay Markets eyeing 2026 launch

InPlay is aiming to launch next year. According to Bloomberg, the company will begin with trading on the NHL and NBA, then branch out to offer other sports, including the 2026 FIFA World Cup. Kane says that, beyond team performance, InPlay will eventually add trading on individual athletic performances, as well.

In a press release announcing Kane’s hiring, the company says its markets will connect with traders through “participating broker-dealers” and will operate on a central limit order book (CLOB) to “ensure transparent price discovery and unified liquidity across the market.” The company says it is working to finalize a contract with a “leading market infrastructure exchange provider” to build its platform.

“Financial markets price commodities, equities, and risk, but they have never priced real-world competitive performance,” InPlay Global’s founder and CEO Edwin Johnson said in the release. “InPlay is changing that by introducing a regulated market structure where performance can be evaluated, traded, and risk-managed transparently. We are not building a gaming product; we are building a market.”

“InPlay is not a sportsbook, prediction market, or gaming platform”

InPlay stresses on its website that trading its Performance Securities isn’t sports betting and that it is also different from trading on prediction markets.

“Performance Securities are distinct from betting, gaming, fantasy, or prediction markets, which rely on odds or binary outcomes rather than market-based price formation,” the company writes in an FAQ section on its website.

“InPlay is not a sportsbook, prediction market, or gaming platform. There are no odds, no wagers, and no house exposure. This is trading with market discipline designed to bring regulated access, price discovery, and financial integrity to performance based exposure.”

InPlay states that participants on the platform will include “market makers, retail traders, and hedgers.” In response to an FAQ about InPlay Markets’ target audience, the company writes that they are targeting “speculators, passionate sports fans, risk managers, and the entire capital markets ecosystem, including retail and institutional traders, market makers, regulators, technology providers, and corporate sponsors.”

InPlay’s trading venue would operate 24 hours a day, seven days a week, according to Bloomberg, to allow trade reactions to game outcomes in real time.

InPlay could join prediction market platforms’ state regulatory battle

Presenting trading on sports outcomes as a financial instrument and new asset class is the same premise on which prediction market platforms have based their operations. InPlay’s insistence that trading securities does not amount to sports betting takes another page from prediction platform playbook.

But that argument hasn’t sat well with several states and gaming tribes, which have been embroiled in legal battles with platforms like Kalshi and Crypto.com. Some gaming regulators from states with a legalized, regulated sports betting market are insisting that the sports event contracts offered by those platforms (and others) are essentially unsanctioned sports betting that should not be permitted in their jurisdictions.

Those court cases are ongoing and may not be resolved ahead of InPlay’s planned launch. Some industry observers say that they anticipate the final decision on prediction platforms’ right to offer sports markets in all 50 states could be made by the Supreme Court, but not for two years or more.

If InPlay gains its SEC and FINRA approval and launches, expect similar pushback from states if there is no Congressional or court resolution in the meantime.