In a letter sent to shareholders last week, DraftKings CEO Jason Robins said that the company will launch event contracts in the “coming months.”

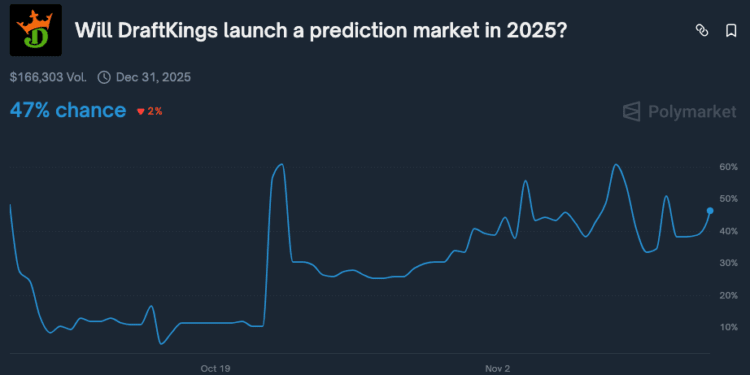

How soon could trading start? According to Polymarket’s market on this exact question, there’s a 47% chance that the sports betting behemoth launches a prediction market by the end of the year — giving ‘Yes’ holders only seven weeks to spare.

The news arrives amid other major headlines shaking the sports betting and prediction markets industries, including a partnership with ESPN that significantly boosts DraftKings’ visibility—and by extension, potentially the profile of their incoming “Predictions” product—as the race to finish on top of yet another winner-takes-most market heats up.

Will DraftKings leverage ESPN for ‘Predictions’?

Penn Entertainment ended its sports betting partnership with ESPN, which means no more ESPN BET. So who is stepping in to be ESPN’s official sportsbook and odds provider? You guessed it: DraftKings.

Might DraftKings leverage its real estate across ESPN to promote DraftKings Predictions, too?

“By comparison Predictions is structurally limited, lacking the depth and breadth of a sports betting offering,” Robins wrote to investors. “There are also numerous data points from around the globe that validate that Predictions, in sports, is relatively small and largely incremental relative to traditional sports betting.”

It’s clear that DraftKings will continue to prioritize its sportsbook business, launching event contracts only in states without legal sportsbooks.

“We plan to focus on the states where we do not offer Sportsbook, which also is where

we believe the vast majority of the financial opportunity exists,” Robins wrote.

In practice, you should still expect to see DraftKings’ traditional American sportsbooks odds cited ahead of any prediction market forecasts.

That said, sports‑adjacent markets could shine when it comes to rumor mills and tent‑pole moments—league coaching carousels and the Super Bowl halftime show performances, for example.

One can easily imagine prediction market prices featured as Stephen A. Smith debates whether Lane Kiffin will leave Ole Miss or if Mike McDaniel will be the next head coach fired.

Then there’s the vast amount of Super Bowl novelty markets — many of which are otherwise prohibited as props by state gaming regulations but will be legal under the federal regulatory framework for event contracts — that could easily find a place in segments across ESPN’s lineup of shows.

But for DraftKings, other partnerships may prove to be better marketing vehicles for its prediction market, especially when it comes to event contracts that have no relation to sports.

NBCUniversal, beyond sports

In September, DraftKings entered a multi-year partnership with NBCUniversal. The deal gives DraftKings a presence across NBC’s deep sports portfolio, which covers the NFL, NBA, Premier League, the upcoming Super Bowl, PGA Tour, and more.

Beyond sports, NBCUniversal’s brands also include Bravo, CNBC, MSNBC, E! News, as well as entertainment destinations like Fandango and Rotten Tomatoes. That breadth could turn into an on‑ramp for politics and pop‑culture markets, potentially attracting a much different audience than what currently frequents its online sportsbook—if DraftKings is able and willing to leverage it.

However, even in the letter announcing plans for its forthcoming “DraftKings Predictions” product, Robins continues to downplay prediction markets’ upside.

“We will be measured in our investment level, understanding that gross profit payback periods need to be shorter relative to our more established product lines, where we have more predictability around what customers we acquire will be worth over time,” Robins wrote.

In other words, a customer trading on politics or entertainment is considered less valuable than a sports trader who can be converted into a more typical sportsbook user if and when DraftKings launches in their state.

“As growth in Predictions continues, this may also motivate more states to legalize online sports betting and iGaming with reasonable regulation and taxation,” Robins wrote.

It must be noted that the DraftKings-NBCUniversal partnership is primarily an advertising commitment. DraftKings may ultimately conclude that there’s too much opportunity cost in promoting DraftKings Predictions when it could be advertising its sportsbook instead.

Barstool’s edgy messengers

A better fit for Predictions, however, may be DraftKings’ partnership with Barstool Sports—an exclusive deal that integrates DraftKings odds and promos across Barstool content. Unlike ESPN, Barstool lives in pop culture almost as much as it does sports. Heck, Barstool itself is a pop culture phenomenon.

Within its universe are a plethora of sports‑agnostic, culture-first podcasts such as “The BFFs with Josh Richards and Brianna Chickenfry,” “Chicks in the Office,” “Macrodosing,” “Out & About,” “Taylor Watch,” and more.

Barstool creators are no strangers to controversy, and do not shy away from spicy news‑cycle topics.

Kevin Clancy, more commonly known as “KFC” to the legion of stoolies, pulled more than 300,000 likes with an Instagram reel about the last papal conclave.

His colleague, “Jack Mac,” regularly riffs on trending stories—including politics—and has cited Polymarket while drawing hundreds of thousands of views.

They and other Barstool personalities may be the perfect messengers for edgy markets that legacy media companies will avoid.

When will DraftKings Predictions launch anyway?

While Robins has signaled an interest in the election betting pie, the initial focus remains on sports and sports event contracts. That is in part why DraftKings Predictions is slated to launch only in states that do not yet offer traditional sports betting.

With that and the company’s recent report in mind, it is reasonable to deduce that DraftKings aims to launch and capitalize on the current football season.

DraftKings has recently posted multiple job openings containing “prediction markets” in the title and, in October, acquired Railbird Exchange and its founding team to expedite its prediction market entry.

“We believe that Railbird’s team and platform—combined with DraftKings’ scale, trusted brand, and proven expertise in mobile-first products—positions us to win in this incremental space,” Robins said announcing the acquisition.

Polymarket’s roughly 50% forecast for a launch by Jan. 1 might be a tad bullish. However, it makes strategic sense for DraftKings to aim for a launch before the NFL playoffs kick off on Jan. 10, or, at the latest, before the Super Bowl.

Whenever DraftKings Predictions launches, Robins is confident that his company’s fashionably late arrival to the prediction market space will outshine the prediction market companies, Polymarket and Kalshi, that launched the party to begin with.

“We will pursue this opportunity, we will compete, and we will win,” Robins wrote. “For the same reasons that we have been successful competing in the sports betting industry, we expect to succeed here.”

“Our database will be a strong competitive advantage. Add in our new agreements with ESPN and NBCUniversal, and DraftKings will have an even stronger presence across the sports landscape in the years ahead.”

It may not just be sports in which its presence grows.

If Robins is underestimating the upside in prediction markets, he has plenty of levers to pull to ensure DraftKings is the same dominant force in the prediction market space as it has been in sports betting and daily fantasy sports before it.