Bank of America analysts are the latest to downgrade DraftKings and FanDuel parent company Flutter Entertainment stocks. The BofA analyst report cites a few headwinds for the downgrade, including increased state taxes, slowing handle growth, unstable betting margins, and unfavorable betting outcomes.

But the bulk of the report, titled “Prediction markets are hard to predict; A challenging event path for OSB operators,” examines the major risks concerning the rapid growth of the prediction market industry.

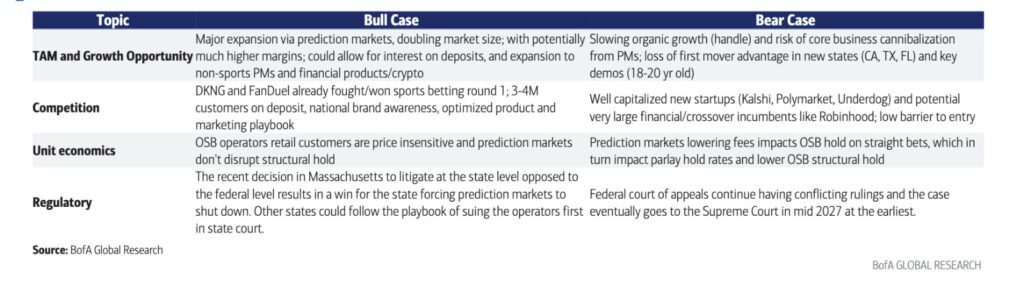

Led by BofA analyst Shaun Kelley, this week’s report opens by saying that there hasn’t yet been cannibalization of online sports betting (OSB) operators’ revenue by prediction market platforms. But, the analysts warn, that could change given the low barriers to entry, increased innovation, and explosive growth in the prediction market space.

The report of course did not account for DraftKings’ imminent sports contract offering, which CEO Jason Robins just announced with Q3 earnings on Thursday.

The “bottom line” of the report notes that, given the uncertain status of current legal challenges to prediction exchanges’ sports event contracts (a leading volume driver), and unabated growth, the threat to OSB operators could be substantial in the coming years.

“Without clear legal resolution, the event path and unit economics of prediction markets could be material overhangs for our space for the next 6-9 months, and possibly for years,” the analysts claim. “We see more negative news ahead in terms of (prediction market) announcements and competition, and possible mixed news as legal developments remain fluid.”

OSB stocks drop in response to positive prediction market news

The analysts downgraded BofA’s rating of Flutter and DraftKings stock from “Buy” to “Neutral.” They also lowered their price objectives on both stocks, taking Flutter down from $325 to $250, and moving Draftkings’ price target from $40 to $35. As of Monday morning, Flutter and DraftKings shares were at $216 and $28, respectively.

This year, Flutter stock has dropped 14% and DraftKings is down 22%, according to Investor’s Business Daily.

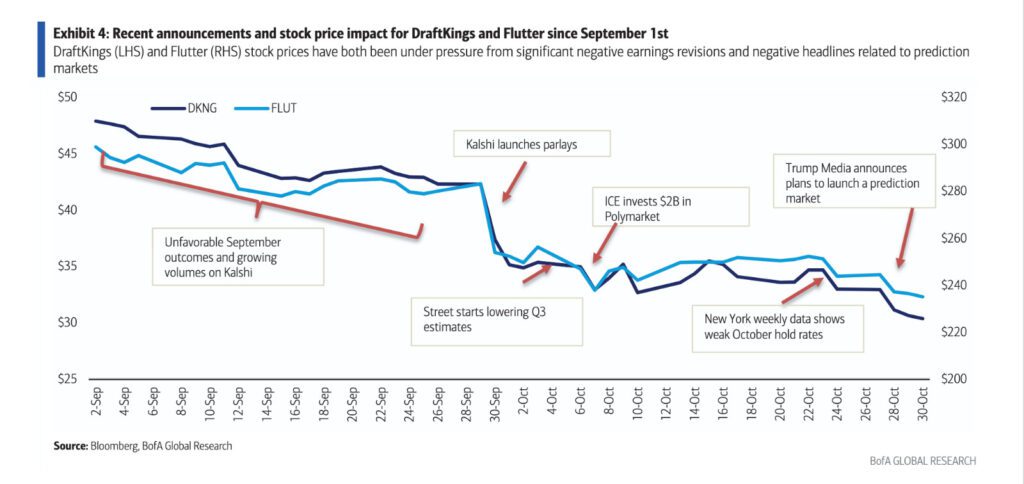

The BofA report tracks the decline in the past couple of months, showing how the stocks have been dropping following major prediction market news, including Kalshi’s introduction of a parlay-like product in September, Intercontinental Exchange, Inc.’s $2 billion investment in Polymarket announced in early October, and Trump Media’s announcement in late October that its Truth Social will be adding Crypto.com prediction markets.

“Unfortunately but not surprisingly, OSB operator stocks have now started reacting negatively to large prediction market announcements,” Kelley recently told Bloomberg.

The analysts say they see more risk ahead in the near future, headlined by Polymarket’s imminent return to the U.S. market. Other potential impactful news developments noted in the report include another large Kalshi funding round, Robinhood acquiring designated contract market (DCM) status from the Commodity Futures Trading Commission (CFTC), and what they say is one of their largest concerns, “iGaming interfaces based on prediction market contracts that blur the line further between trading and gambling.”

Report notes flood of new and diverse prediction market entrants

The analysts also note the increasing number of new entrants into the prediction markets space this year as a cause for concern for OSB companies. Inspired by the multi-billion dollar valuations of Polymarket and Kalshi, as well as what they call “seemingly low barriers to entry,” the report says it’s likely more “large scale players from financials and crypto” will follow the lead of brokers like Robinhood and various crypto exchanges and attempt to get into prediction markets.

The BofA analysts also cite prediction market entries by fantasy sports platforms and social media companies like Trump Media’s Truth Social as a sign that non-financial sectors are also likely to enter the fold and expand prediction markets’ reach. The “low barrier of entry” refers to the relatively easier path of acquiring CFTC approval by registering as a Futures Commissions Merchant (FCM) with the National Futures Association. Robinhood, for example, has FCM status and partners with Kalshi (a DCM) to offer their markets on the RH platform.

But the report doesn’t mention that non-FCMs like Trump Media and fantasy sports platform Underdog have deals with DCM Crypto.com as simply a technology partner in order to offer prediction markets.

Proving the analysts’ point about the flood of new entrants, in the few days since the BofA report was released, there were several other relevant news announcements that showcased prediction markets’ rapid expansion:

- Sweepstakes crypto casino MyPrize also announced a partnership with Crypto.com to offer prediction markets. (The BofA report did mention the potential for a “sweepstakes pivot” as another possible growth area for the industry.)

- The billionaire Winklevoss twins’ crypto exchange Gemini wants to start offering prediction markets “as soon as possible,” according to a Bloomberg report.

- While not (yet?) showing intentions to offer prediction markets, Google announced upgrades to its Google Finance platform will incorporate market data from Kalshi and Polymarket, giving prediction markets another big dose of credibility.

- DraftKings announced in a letter to investors along with Q3 earnings that “The company expects to launch DraftKings Predictions in the coming months, pending licensure,” with plans to “enter many states with sports event contracts, unlocking a new customer base and revenue stream.”

Prediction market boom could resemble OSB’s rise

The BofA analysts compare the state of the prediction market industry to the booming days of OSB growth following the 2018 Supreme Court decision striking down the Professional and Amateur Sports Protection Act (PASPA), which opened the door for states to legalize and regulate sports betting.

The report says that the prediction market landscape could follow a similar path, with a lot of initial players and competition, as operators battle for customers with things like lower fees and promotions. Ultimately, the report suggests, things could level off and the major players (likely Kalshi and Polymarket) will dominate market share.

“At peak in 2021, at least 26 sportsbooks were vying for the original online sports betting market post-PASPA repeal (resulting) in multi-billion dollars losses across traditional brick and mortar gaming companies, media companies, startups, SPACs and others, before the market stabilized and the two clear winners (FanDuel and DKNG) emerged,” the analysts wrote. “Unchecked, this is what PMs could look like in 2026.”

OSB entry into prediction markets carries potentially damaging risk

The BofA report also digs into the legal and regulatory uncertainty facing prediction market platforms. States like Ohio, Michigan, Nevada, Arizona and Illinois have sent letters to sports betting and iGaming licensees in their jurisdictions saying that their licenses could be affected if they choose to offer prediction markets, particularly sports event contracts. Some of the states also warned against offering them in any jurisdiction.

Prediction market entries by OSB operators could blunt some of the financial impact from existing exchanges, but the BofA report notes that those entries come with risks. DraftKings and FanDuel earlier this year announced their intentions to offer prediction markets. DraftKings acquired the CFTC-approved Railbird Exchange, while FanDuel is partnering with the CME Group for a prediction market product.

FanDuel hasn’t publicly indicated that they will offer sports markets. But on Thursday, DraftKings CEO Robins said they are planning to offer sports event contracts in the coming months through their new DraftKings Predictions vertical, focusing initially on states that don’t have DraftKings Sportsbook.

“This landscape makes the risk-reward calculus very difficult. Operators have to toe the line, and potentially risk entering these markets and sacrificing,” the analysts wrote.

Legal resolutions could provide more clarity, but not soon

Several states are also battling prediction market platforms in court over their right to offer sports-related contracts. If restrictions are implemented, that would obviously lessen OSB operators’ direct competition with prediction exchanges.

The BofA analysts say the fastest paths to a resolution of the sports prediction market conundrum would be CFTC or state-level intervention, a “cease/desist requirement while Federal cases are pending,” or a Supreme Court ruling. But, they say, those likely won’t come anytime soon.

“The legal landscape for prediction markets remains highly fluid for OSB operators, but near-term resolution appears unlikely,” the report states.

The analysts say CFTC intervention is probably not going to happen due to “Presidential appointment power, and a pro-crypto, anti-regulation approach towards government involvement.” They say Massachusetts’ challenge in state court could have a ripple effect, but that a resolution will likely not occur until “late Spring/early Summer 2026.”

A resolution of the federal court cases appears ultimately headed to the Supreme Court, but the analysts say the earliest they foresee that happening is summer of 2027 or later.